Solar Signals

Solar SignalsUse adaptive TradingView trading strategies.

Adapt to the market. Optimize returns. Clear entry, exit, size.

Unleash the full power

Your edge on the market.

Offer

Solar Signals Standard

A complete, ready-to-use TradingView strategy built for consistency — entries, exits and sizing handled for you.

- ✔ Full TradingView strategy with clear entry, exit and SL logic

- ✔ Automatic position sizing based on your capital

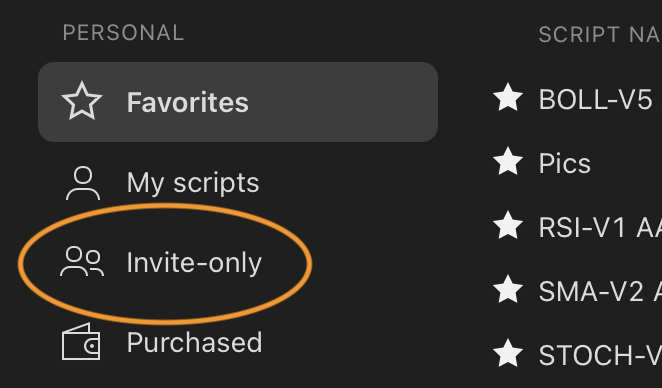

- ✔ Access to the private invite-only script

- ✔ Works with any TradingView-supported broker (webhooks & integrations)

- ✔ Updated every 2 weeks with fresh optimized parameters

- ✔ Email support 7 days a week

- ✔ Designed for the 15-minute timeframe

How it works

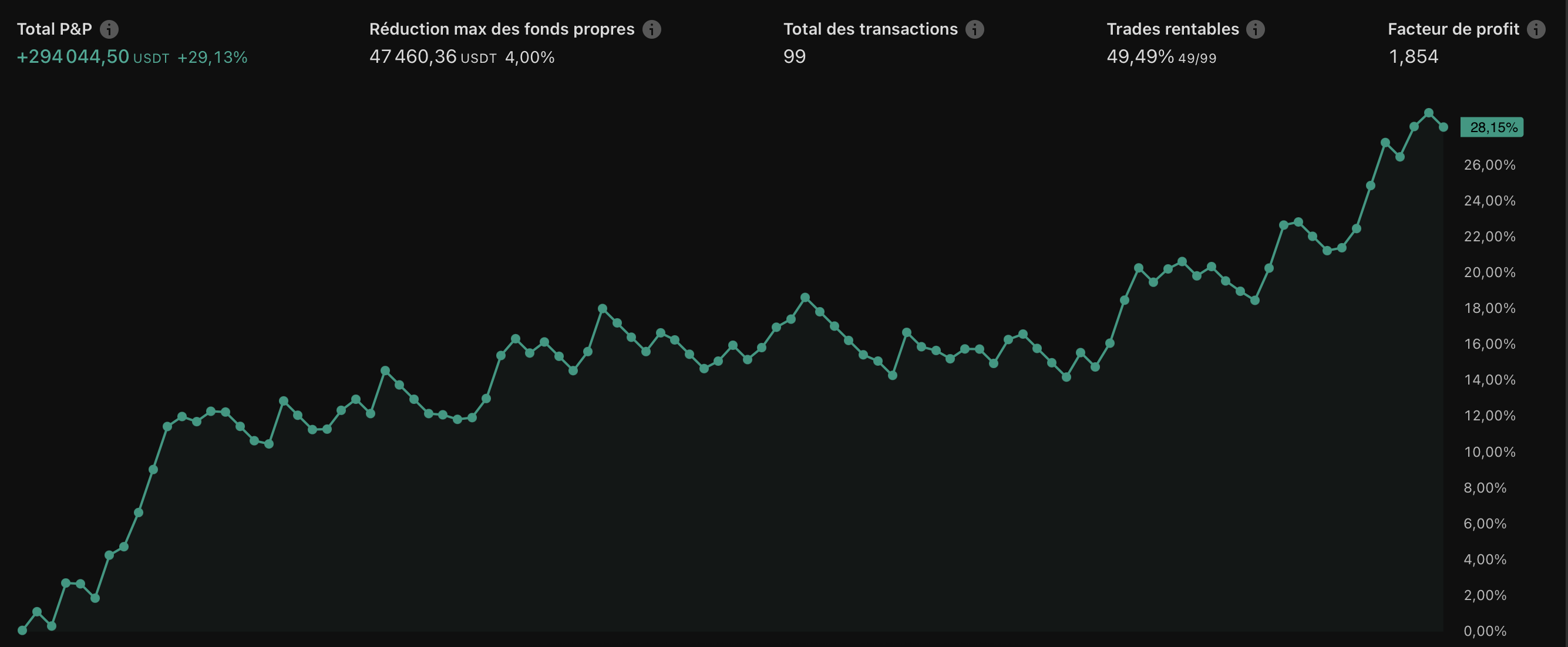

The market is not static, it evolves every week. Most TradingView strategies rely on fixed parameters (SMA windows, RSI smoothing, thresholds…), which makes them break as soon as conditions shift.

Solar Signals is different. It uses an adaptive algorithm that continuously re-evaluates and re-tunes the internal parameters of the strategy based on the current market regime - trend strength, volatility, structure, expansion, contraction... All while avoiding overfitting and preserving generalization.

This creates a strategy that remains stable, consistent and resilient even as the market changes.

I’ve spent several years refining both the adaptive engine and the trading logic behind it. Solar Signals is the result: a robust, engineering-driven strategy made accessible through this company.

Parameters automatically re-tune for any market to pursue optimal, risk-aware performance.

From subscription to execution

Subscribe & get access

You subscribe and receive access to the strategy on TradingView within 24 hours.

Why us?

A professional, realistic and stable solution

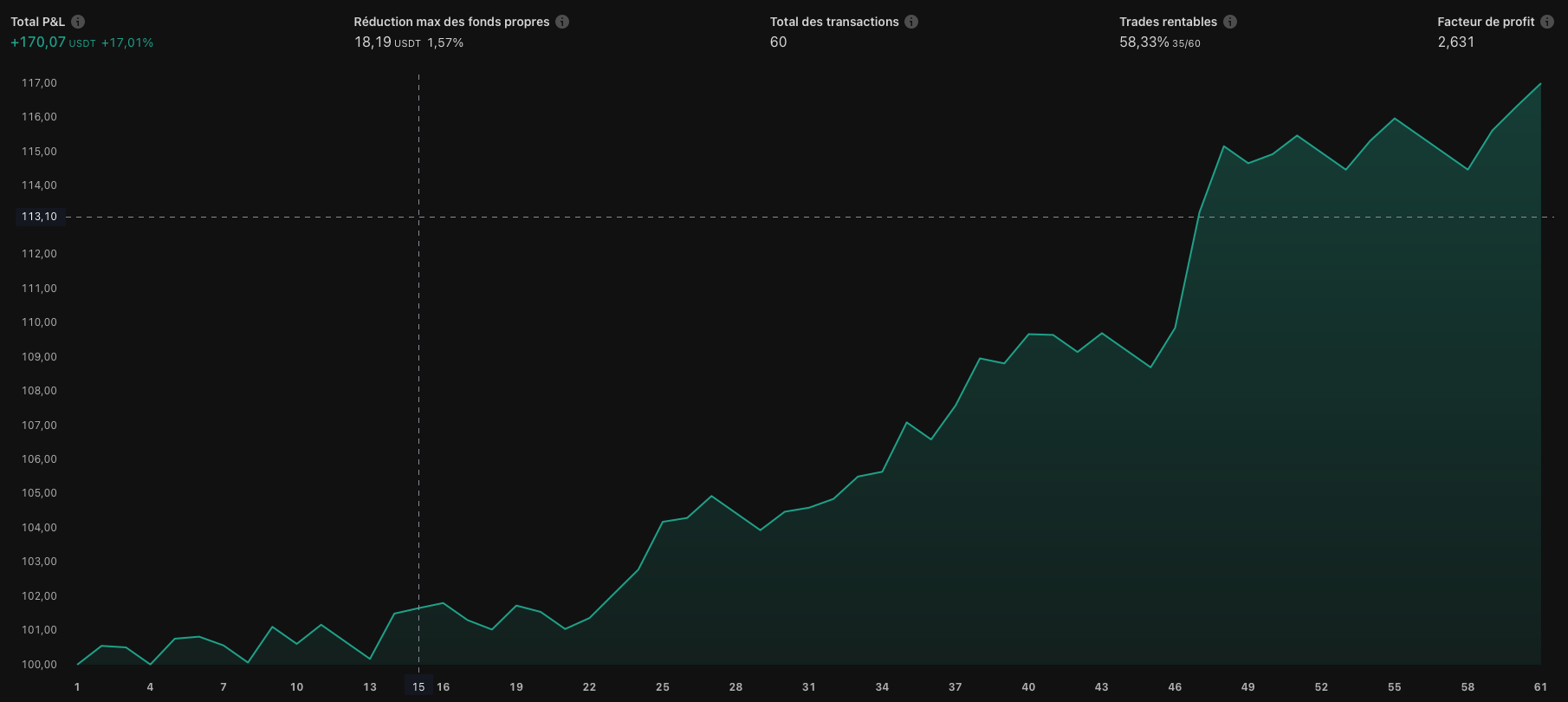

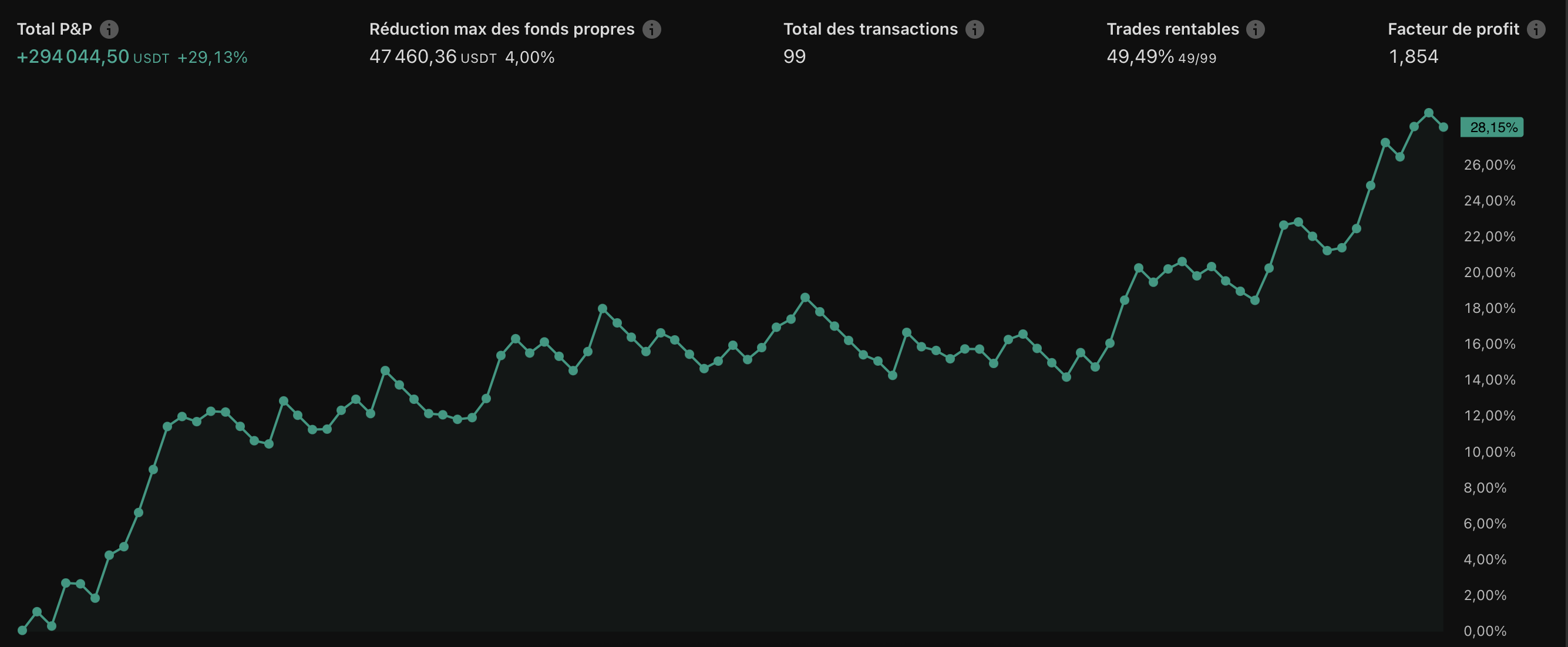

Solar Signals is not a “get-rich-quick” system. It’s a stable, tested, and engineering-driven strategy built to behave consistently across changing market conditions.

The strategy follows strict logic for entries, exits and position sizing, but it cannot eliminate risk entirely — nothing can.

Low trading fees are essential for maximizing performance. Most brokers provide much better conditions on Futures markets, which is why Futures trading is recommended for optimal execution.

🔶 Recommended capital: €2,000 – €5,000

🔶 Recommended trading fees: 0.05% (taker fees)

Connect your strategy to a real trading bot

Solar Signals sends high-quality TradingView alerts. Your broker or automation platform then executes the trades automatically using webhooks or API-based futures bots.

These are only the most popular platforms. If your broker is not listed, check their website — most of them support TradingView webhooks or automated futures trading.

Solar Signals provides algorithmic tools only. Nothing on this website is financial advice. Trading cryptocurrencies involves significant risk of loss. You are fully responsible for using the strategy.

About the creator

I’m an engineer specialized in algorithmic trading and market behavior. I studied Applied Information Technology at the University of Luxembourg, and I have spent the last 5 years building, testing and deploying trading systems — from early prototypes to full production pipelines.

My work focuses on robust engineering: stable logic, adaptive parameters, clean execution flows and measurable performance. I design strategies that behave consistently across different market regimes while staying simple and practical for traders to use every day.

- 5+ years of algorithmic trading experience

- University of Luxembourg graduate

- Adaptive parameters instead of static rules

- Asset-agnostic logic (indices, crypto, metals)

- Backtest → live pipeline engineering

- Clear onboarding and user coaching