Solar Signals

Solar SignalsCustom trading algorithms. Emotionless & Precise.

TradingView (Pine), MetaTrader (MQL), and Python backtesting. I design, validate, and deliver algorithms with clear entries, exits, and sizing.

Trusted for a reason

By builders for traders.

Services

Complete strategies with clean signals, alerts, and risk rules. Broker-agnostic via webhooks.

- Alert templates & execution rules

- Risk management

- Deployment guidance

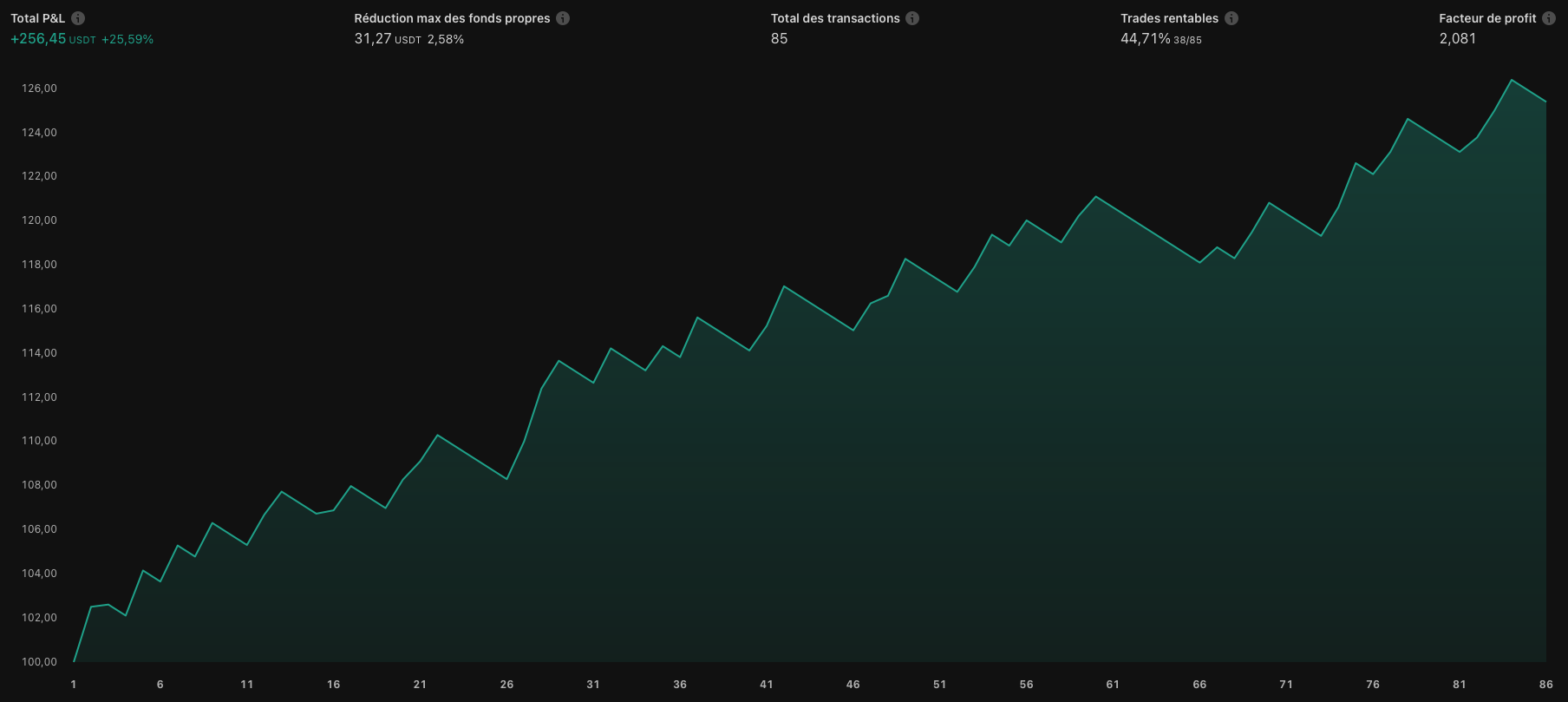

Featured Projects

About the creator

I’m an engineer specialized in algorithmic trading and market behavior. I studied Applied Information Technology at the University of Luxembourg, and I have spent the last 5 years building, testing and deploying trading systems — from early prototypes to full production pipelines.

My work focuses on robust engineering: stable logic, adaptive parameters, clean execution flows and measurable performance. I design strategies that behave consistently across different market regimes while staying simple and practical for traders to use every day.

- 5+ years of algorithmic trading experience

- University of Luxembourg graduate

- Adaptive parameters instead of static rules

- Asset-agnostic logic (indices, crypto, metals)

- Backtest → live pipeline engineering

- Clear onboarding and user coaching

Book a call

30 minutes to map your goals and see if a custom adaptive build is the right fit.